ENGIE Unveils Key Trends for Renewable Energy Buying in North America

Second annual Business Energy Census highlights growing demand for renewables, strategic focus and expectations of higher prices and volatility

HOUSTON – ENGIE Resources, a leading commercial electricity provider and America’s Energy Greentailer™, in collaboration with Energy Research Consulting Group (“ERCG”), today announced the release of the second annual North American Business Energy Census. This comprehensive report offers valuable market insights and opinions from over 100 aggregators, brokers and consultants (ABCs), representing approximately 1.07 million end-use customer locations, reinforcing ENGIE Resources’ position as a thought leader in the Renewable Energy space.

As an affiliate of ENGIE North America (ENGIE) and part of the ENGIE Group, a global leader in the Net Zero energy transition, ENGIE Resources aims to deliver journey-specific insights from diverse firms across various geographical locations, revenue brackets and business models. “As the energy landscape evolves, accurate supplier data and industry statistics are crucial for shaping a sustainable energy strategy,” said J.D. Burrows, Vice President of Customer Analytics and Engagement at ENGIE Resources. “Our goal is to empower businesses with actionable insights that drive informed decisions and the adoption of green energy solutions.”

Based on months of comprehensive research, ENGIE’s annual Business Energy Census report highlights the evolving energy sector and the growing importance of strategic energy management for businesses of all sizes. Survey participants include a spectrum of roles, spanning from owners and C-Suite executives to sales and operation managers. The 2024 Business Energy Census identifies several mega-trends that indicate heightened volatility and uncertainty in the energy market, including:

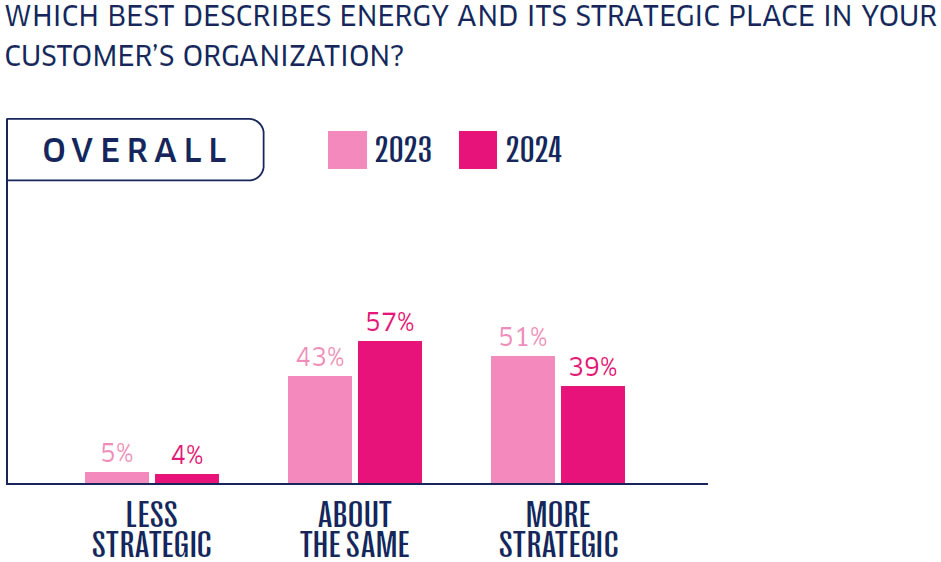

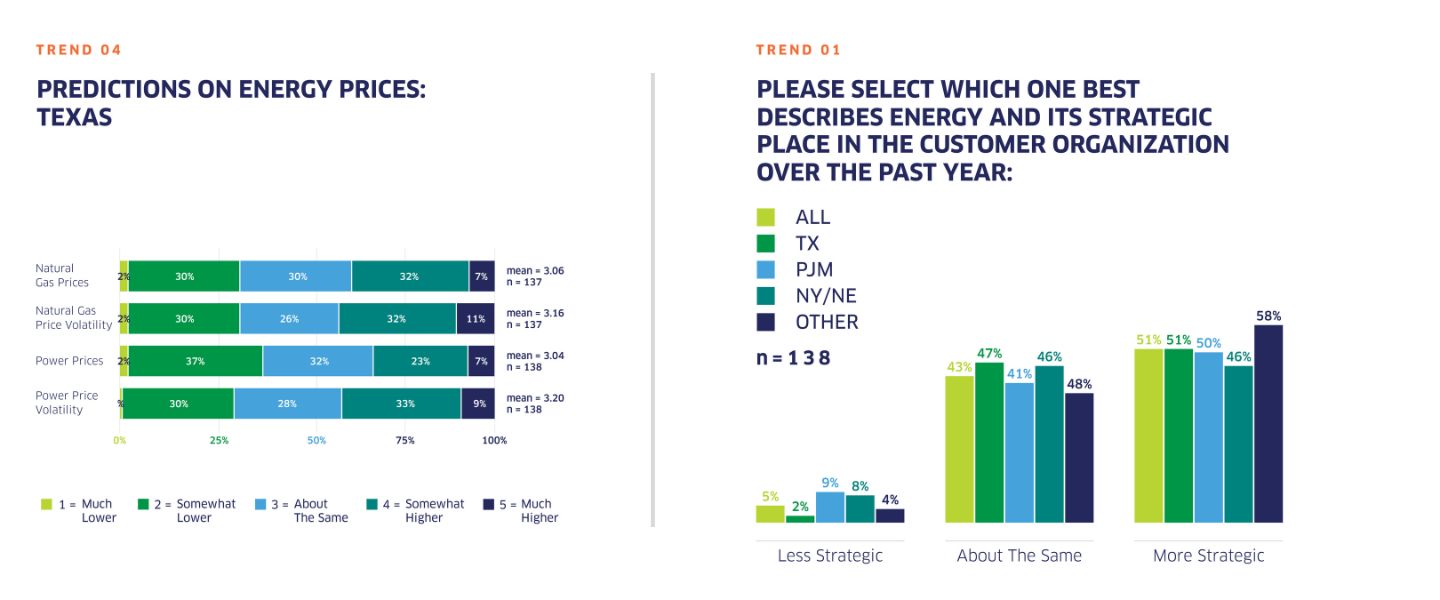

Trend One – Shifting Strategic Perspectives – 57% of respondents, up from 43%, in the previous year, believe that the strategic importance of energy has grown to reach a point of equilibrium. This change aligns with the stabilization of energy prices and growing confidence in the effectiveness of existing energy strategies.

Trend Two – Forecast of Rising Prices and Volatility – 40% of respondents expect power and natural gas prices and volatility to increase, suggesting a need for more robust risk management strategies.

Trend Three – The Rise in Green Premium Acceptance – There is an increase in willingness to pay a premium for Green Energy. 62% of customers are willing to pay a small premium, compared to 56% in 2023, indicating a growing acceptance of green energy solutions. Year to year, we have also seen a decrease from 28% to 18% of survey participants who said their customers are not willing to pay any premium at all for renewable energy. These trends could be an indication of the future of energy and an increase in company initiatives to transition to net-zero emissions.

Trend Four – From Policy to Action: Strengthening Regulatory Support – Respondents expressed a notable lack of confidence in the regulators’ ability to structure markets conducive to fostering three principles: competition, transparency and innovation. Despite the overarching sentiment, there is a marked improvement in attitudes compared to 2023, hinting at a growing belief that regulatory support is on an upward trajectory, albeit slowly.

Trend Five – Driving Forces: Energy’s Impact on Mergers and Acquisitions – 45% of respondents reported that energy prices and volatility are less of a disruptive force in deterring or delaying major initiatives such as mergers, acquisitions and expansions compared to previous years. This shift indicates a stabilizing effect of the energy market on strategic corporate decision-making.

Trend Six – From Data to Decisions: Empowering Stakeholders with Market Insights – 48% of Texas respondents believe that current market information is inadequate for making informed decisions, surpassing the national dissatisfaction rate by 11%. There is a clear indication that market participants are advocating for more and better energy market information.

“Too often, we hear from people outside our industry telling us what business customers are looking for in their energy solutions,” said Young Kim, Principal at Energy Research Consulting Group. “It is about time that our industry speaks for itself. I am proud to partner with ENGIE Resources to cover the most pressing energy issues affecting the business community and to reveal key insights that our industry can use.”

Through the 2024 Business Energy Census customers and partners can find observations that confirm the strategy to support the development and delivery of green energy solutions for power and gas customers.

Get instant access to the report by filling out the fields below.

###

About ENGIE North America

Based in Houston, Texas, ENGIE North America Inc. is a regional hub of ENGIE, a global leader in low-carbon energy and services. ENGIE (ENGI), is listed on the Paris and Brussels Stock Exchanges. Together with our 97,000 employees around the globe, our customers, partners and stakeholders, we are committed to accelerate the transition toward a carbon-neutral world, through reduced energy consumption and more environmentally friendly solutions. Inspired by our purpose (“raison d’être”), we reconcile economic performance with a positive impact on people and the planet, building on our key businesses (gas, renewable energy, services) to offer competitive solutions to our customers. In North America, ENGIE helps our clients achieve their energy efficiency, reliability, and ultimately, their sustainability goals, as we work together to shape a sustainable future. We accomplish this through: energy efficiency projects, providing energy supply (including renewables and natural gas), and the development, construction and operation of renewable energy assets (wind, solar, storage and more). For more information on ENGIE North America, please visit our LinkedIn page or Twitter feed, www.linkedin.com/company/engie-north-america-inc and twitter.com/ENGIENorthAm.

About Energy Research Consulting Group (ERCG)

Energy Research Consulting Group (ERCG) provides business intelligence and consulting services to energy market participants on entry strategies, investment opportunities, and market & policy dynamics. For more information about ERCG’s experience, research and consulting offerings please visit: www.ercg-us.com.

Media Contacts:

ENGIE North America: Michael Clingan, michael.clingan@external.engie.com, (832) 745-6057